The Best Time To Buy a Home This Year

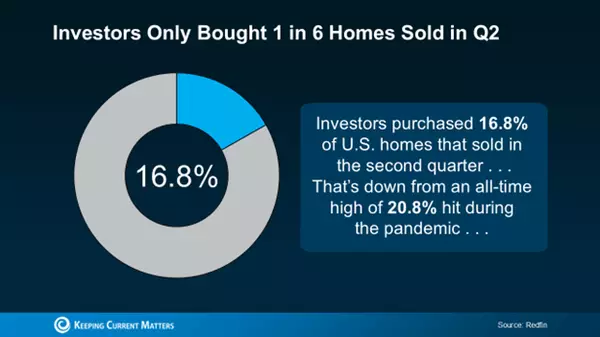

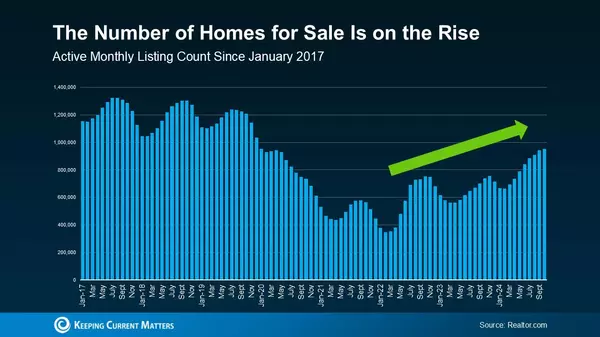

If you’ve been waiting for the perfect moment to jump into the housing market, now could be your time! According to experts, the best week to buy a home in 2024 is right around the corner, offering you a prime opportunity to secure a great deal. When Is the Best Time to Buy? Realtor.com has analyzed seasonal trends and found that the week of September 29 to October 5 is typically the most favorable for buyers. Here’s why this period stands out: Higher Inventory: There are generally more homes available during this time, giving you more options to choose from. Lower Prices: Prices tend to dip from their summer peaks, making it an ideal time for budget-conscious buyers. Reduced Competition: Buyer demand usually slows, meaning fewer bidding wars and more room for negotiation. Slower Pace: Homes stay on the market longer, giving you the breathing room to make decisions without rushing. Why This Year Stands Out In addition to these seasonal factors, current market trends make this year’s fall season particularly attractive for buyers. Here are some key points to consider: Falling Mortgage Rates: Mortgage rates have recently dropped to their lowest level in 19 months, significantly improving affordability. According to Andy Walden from Intercontinental Exchange Inc. (ICE), this recent dip in rates has provided much-needed relief to homebuyers, making August the most affordable month since February. Increased Inventory: Ralph McLaughlin, Senior Economist at Realtor.com, notes that the number of homes on the market is 35.8% higher than last year, marking the 10th straight month of inventory growth. This means more choices for you, and less pressure to settle for a home that doesn’t check all your boxes. Motivated Sellers: With more homes on the market, sellers are competing for your attention. This increased competition often leads to better opportunities for buyers to negotiate favorable terms, from price reductions to covering closing costs. The Sweet Spot Is Here As Zillow puts it, this time of year presents a unique “sweet spot” for buyers, offering less competition, motivated sellers, and better financing options. If you’ve been waiting for the right time, this could be it. Bottom Line To take advantage of these favorable market conditions, it’s essential to be prepared. Connect with a local real estate agent to start your home search and get off the sidelines. This fall, the market is primed to work in your favor – don’t miss out on this opportunity!

Read More

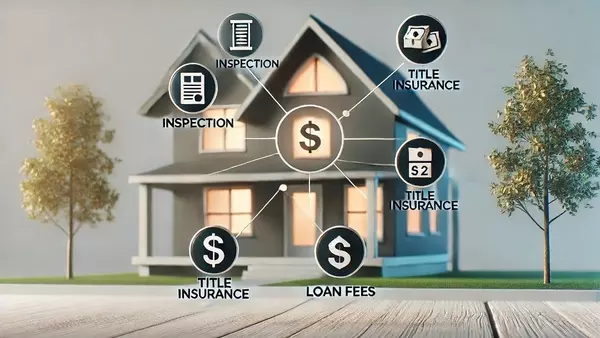

A Guide to Understanding Closing Costs

A Guide to Understanding Closing Costs As you prepare to buy a home, it's essential to budget for more than just the down payment. Closing costs are often overlooked, but they're a crucial part of the homebuying process. Here’s what you need to know to avoid surprises. What Are Closing Costs? Closing costs are additional fees that must be paid when finalizing your home purchase. These costs can vary based on the price of the home and your financing terms, but all buyers should plan for them. Typical fees include: Application and credit report fees Loan origination and appraisal costs Home inspection, title insurance, and homeowners insurance Attorney, survey, and recording fees Some of these are one-time expenses, while others, like homeowners insurance, represent ongoing responsibilities. How Much Should You Expect to Pay in Closing Costs? Closing costs generally range from 2% to 5% of the purchase price. For instance, if you're buying a home at the median price of $422,600, your closing fees could range from $8,452 to $21,130. Homes priced higher or lower will result in different closing costs, so it’s essential to plan accordingly. Tips for Reducing Closing Costs There are a few ways to manage or reduce your closing costs: 1. Negotiate with the Seller: Sellers may be willing to cover some or all of your closing costs, especially in a slower market. Don’t hesitate to ask for concessions like a credit toward these fees or having the seller pay for the home inspection. 2. Shop Around for Home Insurance: Rising insurance costs make this a prime area for savings. Comparing quotes from various insurance companies can help you secure the best coverage at the lowest price. 3. Explore Closing Cost Assistance Programs: Various programs exist to assist with closing costs based on income, profession, or location. Ask your real estate professional or consult HUD resources for programs in your area.

Read More

Mortgage Rates Drop to 6% — What Could Happen Next?

Mortgage Rates Drop to 6% — What Could Happen Next? **Key Points:**- 30-year mortgage rates dropped to 6.2%, the lowest since early 2023.- High home prices still make it hard for some buyers, but price growth is slowing down.- Economists predict the Federal Reserve might start cutting interest rates soon, with more cuts possibly on the way. Mortgage rates have fallen this week, reaching their lowest point in more than a year and a half. As economic trends continue, experts believe the Federal Reserve may cut rates further, which could affect mortgage rates even more in the coming months. Mortgage Rates Hit 6.2% The average 30-year fixed-rate mortgage is now 6.2%, down from the previous week’s 6.35%, according to Freddie Mac. This marks the lowest rate since February 2023. This drop gives homebuyers a chance to borrow money at a lower cost, potentially saving thousands over the life of a loan. While this might seem like a great opportunity for buyers, many are still waiting. Home prices are still high, and there aren't many homes available. Freddie Mac’s Chief Economist, Sam Khater, explained that even though rates are improving, buyers are holding off because of these challenges. A Small Uptick in Mortgage Applications There’s been a slight increase in people applying for mortgages, including both home purchases and refinancing. Joel Kan, an economist from the Mortgage Bankers Association, said that while more people are applying, the high prices are still making it tough for many to commit to buying. The good news is that home prices are slowing down. Over the summer, prices grew at a slower pace, and in July, prices stayed the same month-over-month. Prices are still up about 4.3% compared to last year, but experts predict that the growth will slow by nearly half in the coming year. Inflation and the Federal Reserve Inflation is also cooling down. In August, it dropped to 2.5%, the lowest level since early 2021. This is good news for overall affordability, but housing costs remain high, with rents and home prices still putting pressure on buyers. With inflation dropping and a recent report showing weaker-than-expected job growth, it’s almost certain that the Federal Reserve will lower interest rates soon. This is great for people with credit cards or auto loans, but the effect on mortgage rates might be less noticeable. Experts say mortgage rates have already started to reflect expected Fed cuts since July. What’s Next for Mortgage Rates? Some economists think the rate cut this September will just be the start. There could be more cuts in the months ahead. If this happens, mortgage rates could drop further, possibly falling to the mid-5% range by spring. Lower rates are likely to bring more buyers into the market, meaning the housing market could heat up in 2025. For buyers and sellers, this means that while prices are still high, there may be better opportunities ahead as mortgage rates continue to drop and the market becomes more favorable.

Read More

What the Next Federal Reserve Meeting Means for Your Mortgage and Home Buying Plans

As the next Federal Reserve meeting approaches, you might be wondering what it means for your mortgage and whether now is the right time to buy a home. If you’ve been hearing a lot of buzz about potential changes to interest rates, you’re not alone. These decisions can significantly impact your wallet, especially when it comes to buying a house. Let's break down what you need to know in a way that’s easy to understand. The Big Question: Will the Fed Cut Interest Rates? Everyone’s talking about the possibility that the Federal Reserve might cut interest rates at their next meeting in September. You might be asking, "Why should I care?" Well, the Federal Reserve doesn’t directly set mortgage rates, but their decisions influence them. When the Fed lowers the federal funds rate, it signals a cooling economy, which often leads to lower mortgage rates. And lower mortgage rates can mean a lower monthly payment on your dream home. Why Is Everyone So Focused on the Fed Right Now? Three main things are driving the Fed's decisions: inflation, unemployment, and job growth. Let’s break it down: Inflation: You’ve probably noticed prices going up over the past couple of years. To slow this down, the Fed raised interest rates to make borrowing more expensive, which cools off spending and helps bring prices down. Recently, inflation has started to ease up, getting closer to the Fed’s target of 2%. This is one reason why they might consider lowering interest rates soon. Unemployment: While the job market has been strong, there’s been a slight uptick in unemployment recently. The Fed sees this as a sign that the economy is cooling off, which supports the case for a rate cut. Job Reports: Fewer jobs were added in July than expected, which is another indicator that the economy is slowing down. This cooling job market makes it more likely that the Fed will decide to cut rates in September. What Do the Experts Say? According to a recent survey, nearly 80% of economists think the Fed will cut interest rates by a quarter of a percent in September. This might sound small, but it could be the first of several cuts over the next year or so. These rate cuts are aimed at making borrowing cheaper, which could help bring mortgage rates down a bit. What Does This Mean for You? If you’re thinking about buying a home, this news might have you wondering if you should wait for mortgage rates to drop further. While it’s true that rates could come down slightly, don’t expect a return to the ultra-low rates we saw in 2020 and 2021. Instead, experts predict a gradual easing of rates, possibly bringing them down to the low 6% range by the end of 2025. So, if you’re ready to buy and have found a home you love, now might actually be a great time to lock in a deal. With inventory (the number of homes for sale) increasing slightly, you could find less competition right now than if you wait. Plus, as rates begin to ease, more buyers could jump back into the market, driving prices up. Why Timing the Market Is Tricky You’ve probably heard that trying to "time the market" can be a gamble. Waiting for the perfect moment could mean missing out on a good opportunity. The truth is, no one can predict exactly when rates will hit their lowest point. What’s more important is finding a home that meets your needs and fits your budget. If you’re in the market to buy, consider your personal circumstances first. Are you financially ready? Does buying now make sense for your life? If so, waiting for rates to drop a fraction of a percent might not be worth it. How to Make the Best Decision Navigating the real estate market can feel overwhelming, especially with all the economic changes happening. But you don’t have to do it alone. A knowledgeable real estate agent can help you understand what’s going on with mortgage rates and guide you in making the best decision for your situation. Remember, the goal isn’t to find the perfect moment to buy a house—it’s to find the right house at a time that works for you. As mortgage rates are expected to ease slightly over the next year, now could be your opportunity to secure a home before the market gets more competitive. The Bottom Line The Federal Reserve’s next meeting could bring changes that might affect your mortgage rate, but these changes are likely to be gradual. If you’re ready to buy a home, now might be the right time to act. By understanding what’s happening with the economy and working with a trusted real estate professional, you can make an informed decision that’s right for you. So, keep an eye on the Fed, but don’t let it be the only factor in your decision-making process. Your dream home could be waiting for you right now!

Read More

Categories

Recent Posts