Mortgage Rates Drop to 6% — What Could Happen Next?

Mortgage Rates Drop to 6% — What Could Happen Next?

**Key Points:**

- 30-year mortgage rates dropped to 6.2%, the lowest since early 2023.

- High home prices still make it hard for some buyers, but price growth is slowing down.

- Economists predict the Federal Reserve might start cutting interest rates soon, with more cuts possibly on the way.

Mortgage rates have fallen this week, reaching their lowest point in more than a year and a half. As economic trends continue, experts believe the Federal Reserve may cut rates further, which could affect mortgage rates even more in the coming months.

Mortgage Rates Hit 6.2%

The average 30-year fixed-rate mortgage is now 6.2%, down from the previous week’s 6.35%, according to Freddie Mac. This marks the lowest rate since February 2023. This drop gives homebuyers a chance to borrow money at a lower cost, potentially saving thousands over the life of a loan.

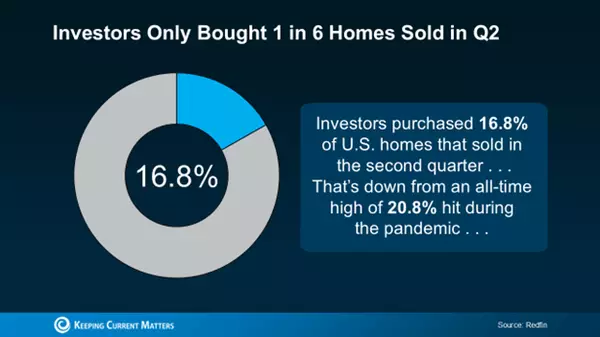

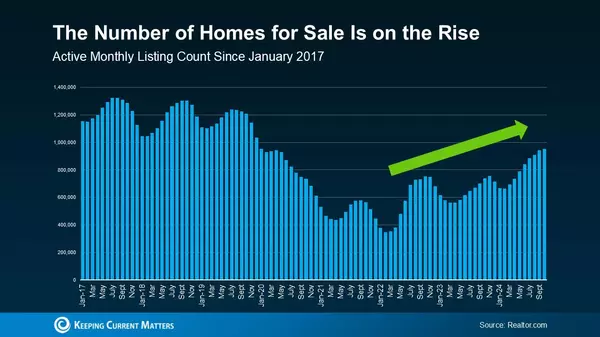

While this might seem like a great opportunity for buyers, many are still waiting. Home prices are still high, and there aren't many homes available. Freddie Mac’s Chief Economist, Sam Khater, explained that even though rates are improving, buyers are holding off because of these challenges.

A Small Uptick in Mortgage Applications

There’s been a slight increase in people applying for mortgages, including both home purchases and refinancing. Joel Kan, an economist from the Mortgage Bankers Association, said that while more people are applying, the high prices are still making it tough for many to commit to buying.

The good news is that home prices are slowing down. Over the summer, prices grew at a slower pace, and in July, prices stayed the same month-over-month. Prices are still up about 4.3% compared to last year, but experts predict that the growth will slow by nearly half in the coming year.

Inflation and the Federal Reserve

Inflation is also cooling down. In August, it dropped to 2.5%, the lowest level since early 2021. This is good news for overall affordability, but housing costs remain high, with rents and home prices still putting pressure on buyers.

With inflation dropping and a recent report showing weaker-than-expected job growth, it’s almost certain that the Federal Reserve will lower interest rates soon. This is great for people with credit cards or auto loans, but the effect on mortgage rates might be less noticeable. Experts say mortgage rates have already started to reflect expected Fed cuts since July.

What’s Next for Mortgage Rates?

Some economists think the rate cut this September will just be the start. There could be more cuts in the months ahead. If this happens, mortgage rates could drop further, possibly falling to the mid-5% range by spring. Lower rates are likely to bring more buyers into the market, meaning the housing market could heat up in 2025.

For buyers and sellers, this means that while prices are still high, there may be better opportunities ahead as mortgage rates continue to drop and the market becomes more favorable.

Categories

Recent Posts

GET MORE INFORMATION

REALTOR® | Lic# S.0184988