Is Wall Street Really Buying All the Homes?

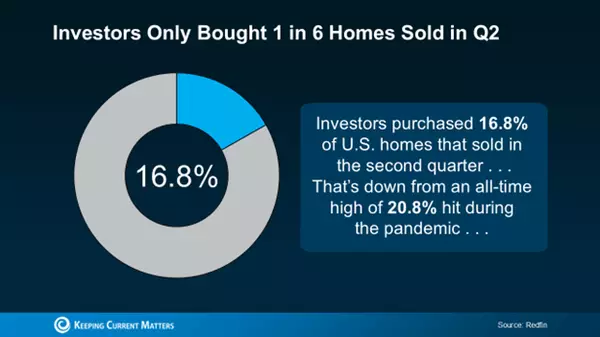

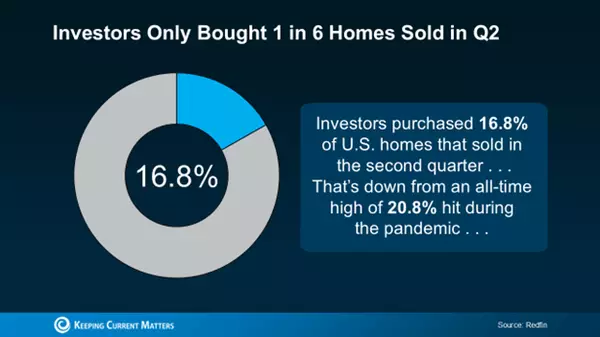

Let’s face it – buying a home right now can feel like an uphill battle. Between scrolling through endless listings, competing at open houses, and losing out to higher offers, it’s easy to wonder if there’s something bigger at play. You might’ve heard a common theory: Wall Street investors are buying up all the homes, leaving little for everyday buyers. But is that true? Not really. While investors play a role, they’re not dominating the market as much as you might think. Here’s a breakdown of the facts to help you separate myth from reality. Investors Make Up a Small Portion of the Market According to Redfin, institutional investors (like Wall Street firms) account for a relatively small fraction of home purchases: Graph: Share of Home Purchases by Investors vs. Everyday Buyers This means five out of every six homes are being purchased by individuals like you, not by big investors. The majority of homebuyers are still everyday people looking for a place to live, not massive corporations buying up properties. Most Investors Are Small “Mom-and-Pop” Owners When you hear "investor," you might picture a massive Wall Street firm buying thousands of properties. But the reality is much different. According to CoreLogic, most investors are small-scale individuals who own fewer than 10 properties. These might include: A neighbor renting out a second home. Someone with a vacation property. Local landlords with a handful of rental units. In fact, large institutional investors (those owning thousands of homes) account for only about 1% of the market. So, while investors exist, the overwhelming majority are small-scale, everyday individuals. Investor Purchases Are Declining Not only are most investors small, but overall investor activity has been dropping. According to CoreLogic’s Investor Report: “Investors made 80,000 purchases in June 2024, compared with 112,000 in June 2023, and a nearly 50% drop from the high of 149,000 purchases in June 2021.” This sharp decline in investor purchases shows that competition from investors is easing. Projections indicate this downward trend will continue into 2025, giving everyday buyers more breathing room. Key Takeaways If you’re feeling discouraged in today’s housing market, it’s important to know the facts: Institutional investors aren’t dominating the market. Most homes are purchased by everyday buyers. Small-scale investors make up the majority of investor purchases. Wall Street’s share is minimal. Investor activity is on the decline. Competition from investors is waning, giving buyers a better chance. Bottom Line The idea that Wall Street is buying up all the homes is largely a myth. Most investors are small “mom-and-pop” landlords, and overall investor activity is slowing. That means you don’t need to worry as much about competing with investors as you navigate the market. If you’re ready to explore homebuying opportunities or want a better understanding of the current housing market, connect with a local real estate agent today. They’ll provide you with the latest insights and guide you through the process with confidence.

Read More

Should You Sell Your House or Rent It Out?

When you're preparing to move, deciding whether to sell your current home or rent it out can be a big decision. In recent years, more homeowners are choosing to explore the rental market instead of selling. According to Zillow, about 66% of sellers recently considered renting their home before listing, and nearly 28% gave it serious thought. This is a notable increase from 2021, when fewer than half (47%) considered renting. Clearly, the idea of renting is becoming more popular among homeowners. So, which is the better choice for you—selling your home and using the funds to purchase a new property or keeping it as a rental to build long-term wealth? Here are some important questions to help you decide based on your financial and lifestyle goals. Is Your Home Suitable for Renting? Before deciding, consider if your property is a good fit as a rental. For example, if you’re moving far away, managing maintenance and tenant concerns from a distance could be challenging. Also, think about whether your neighborhood is renter-friendly or if your property needs substantial repairs to attract reliable tenants. If managing these issues seems daunting, selling may be the simpler and more practical route. Are You Prepared for the Responsibilities of Being a Landlord? Owning a rental property involves more than just collecting rent each month—it’s a commitment that can require time, energy, and resources. As a landlord, you may receive calls for repairs at any hour, deal with property damage, and possibly face tenants who miss payments or break their lease. Handling these situations can be stressful and financially draining. As Redfin points out: “Landlords have to fix things like broken pipes, defunct HVAC systems, and structural damage, among other essential repairs. If you don’t have a few thousand dollars on hand to take care of these repairs, you could end up in a bind.” Do You Understand the Costs Involved? If renting appeals to you for its potential passive income, be sure to factor in the additional costs. Bankrate explains several financial considerations: Mortgage and Property Taxes: You’re responsible for these payments even if the rental income doesn’t cover them fully. Insurance: Landlord insurance costs about 25% more than regular homeowner’s insurance but is essential to cover damages and liability. Maintenance and Repairs: Experts suggest setting aside at least 1% of the home’s value annually for maintenance, with older homes often requiring more. Tenant Search Costs: Advertising and background checks can add to your expenses when looking for tenants. Vacancies: Periods without tenants mean you’re covering the mortgage without rental income. Property Management and HOA Fees: If you hire a property manager, expect to pay around 10% of the monthly rent. Any HOA fees are also your responsibility. Bottom Line Whether to sell or rent out your home is a personal decision that depends on your financial situation and future plans. Carefully weigh the pros and cons, and consider consulting with professionals, like a real estate agent, to ensure you feel supported and informed as you make this important decision.

Read More

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

For nearly 80 years, VA home loans have helped countless Veterans achieve the dream of homeownership. However, recent insights from Veterans United reveal that only 3 in 10 Veterans know they may qualify to buy a home without a down payment. This underscores the importance of awareness around this valuable program. Veterans, and anyone who supports them, should understand these resources that make the journey to homeownership easier – ensuring that life-changing plans don’t get delayed. As Veterans United explains: “The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.” The Advantages of VA Home Loans VA home loans are specifically designed to make homeownership attainable for those who have served. Here are the key benefits, according to the Department of Veterans Affairs: No Down Payment Required: A standout benefit is the ability for eligible Veterans to buy a home with no down payment, making it easier to take that first step into homeownership. Limited Closing Costs: VA loans limit the types of closing costs Veterans must cover, helping to keep more money in your pocket when you’re ready to finalize the sale. No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This results in lower monthly payments and significant savings over time. Your team of real estate professionals, including a local agent and a trusted lender, is your best resource for understanding the options and advantages available to help you reach your homebuying goals. Bottom Line Homeownership remains a cornerstone of the American Dream, and VA home loans offer a powerful opportunity for those who have served our country. Partner with a real estate professional to ensure you have the information and support you need to make confident, informed decisions in today’s housing market.

Read More

More Homes, Slower Price Growth – What It Means for You as a Buyer

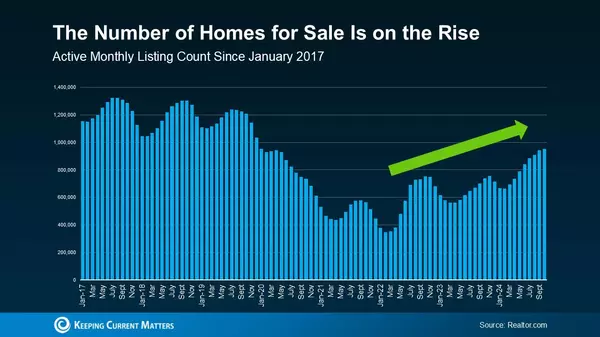

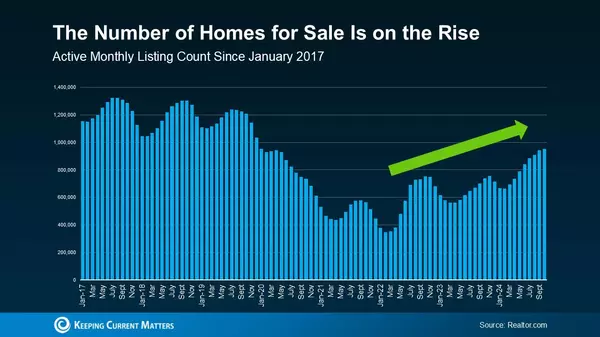

If you’re considering buying a home, the current housing market might just be in your favor. With more homes for sale than we've seen in recent years, there are two key reasons why this shift could be a game changer for buyers like you. More Choices for Buyers This year has brought a noticeable increase in the number of homes on the market. A recent article from Realtor.com highlights this rise in available homes: "There were 29.2% more homes actively for sale on a typical day in October compared with the same time in 2023, marking the twelfth consecutive month of annual inventory growth and the highest count since December 2019." While inventory hasn’t completely returned to pre-pandemic levels, this growth is a significant improvement (see graph below). With this larger inventory, you have more options to find a home that suits your lifestyle and needs. Hannah Jones, a Senior Economic Research Analyst at Realtor.com, reinforces this point: "Though still lower than pre-pandemic, burgeoning home supply means buyers have more options..." This expanded selection gives you the luxury of more time and choice, reducing the rush that buyers often feel when there are fewer homes available. With more properties on the market, the competition may also be less intense. Slower Home Price Growth During times of limited supply, buyers compete heavily for available homes, driving prices up. Recently, however, as inventory has increased, the rapid rise in home prices has started to decelerate (see graph below). In certain areas, the number of available homes has even surpassed pre-pandemic levels, leading to flat or even declining prices. Lance Lambert, Co-Founder of ResiClub, notes: "Generally speaking, housing markets where active inventory has returned to pre-pandemic 2019 levels have seen home price growth soften or even decline outright from their 2022 peak." This slowdown in price growth can be beneficial if you’re budget-conscious. According to Dr. Anju Vajja, Deputy Director at the Federal Housing Finance Agency (FHFA): "For the third consecutive month U.S. house prices showed little movement... relatively flat house prices may improve housing affordability." While these trends are promising, it's essential to remember that housing conditions vary by location. Having a knowledgeable local real estate agent can make a difference, as they’ll be well-versed in current market dynamics in your area, helping you navigate inventory and pricing trends to find the right fit. Bottom Line The current market conditions – more options and slower price growth – create a favorable environment if you’re looking to buy. Take advantage of these changes by connecting with a local real estate agent who can guide you through the increased opportunities in today’s housing market.

Read More

Categories

Recent Posts