Why Buying Now May Be Worth It in the Long Run

Deciding whether to buy a home now or wait is a common dilemma. However, one key factor to consider is the potential to build equity as soon as you purchase a home. Even with moderate price increases, your equity can grow significantly over time. According to the latest Fannie Mae Home Price Expectations Survey, home prices are expected to continue rising through 2028, meaning that buying now could lead to substantial equity gains. For instance, purchasing a $450,000 home today could result in over $90,000 in equity in the next five years. (see the graph below) While rising prices may seem daunting, they also represent an opportunity to build wealth. If you’re ready to buy and growing your wealth is important to you, now might be the right time to make a move. The Importance of Expert Guidance Navigating today’s housing market can be complex, so it’s essential to consult with a real estate professional who can provide insight into local market conditions and help you make an informed decision. As The Mortgage Reports highlights, staying informed and working with a professional is crucial in the current market. Bottom Line Deciding whether to buy now or wait is a personal decision, but it’s important to consider the potential equity you could gain by purchasing sooner rather than later. If you’re weighing your options, connect with a local real estate agent who can guide you through the process and help you make the best decision for your financial future.

Read More

The Down Payment Assistance You Didn’t Know About

Did you know that nearly 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually take advantage of it? If you’re planning to buy a home, this is a gap you can’t afford to ignore. Maximize Your Down Payment Options First-time buyers can benefit from various resources, including loan options with as little as 3% down, or even 0% for qualified buyers like Veterans. Additionally, down payment assistance programs, such as grants, can help cover upfront costs. These resources not only boost your down payment but can also lower your monthly mortgage payments and potentially reduce fees like private mortgage insurance. Don’t Be Deterred by Headlines Recent news might suggest that down payments are on the rise. For example, Redfin reports that the typical down payment hit a record high of $67,500 in June. However, this increase reflects the choices of current homeowners who are leveraging their home equity to put down larger amounts, not a rise in down payment requirements. Larger down payments help lower monthly mortgage payments, which is crucial in today’s market. Bottom Line The best move you can make is to consult with a trusted lender. They can help you explore your options and access down payment assistance programs you might not even know exist. Working with a professional ensures you’re not leaving any money on the table and can help you get closer to your dream of homeownership.

Read More

Is Your House Priced Too High?

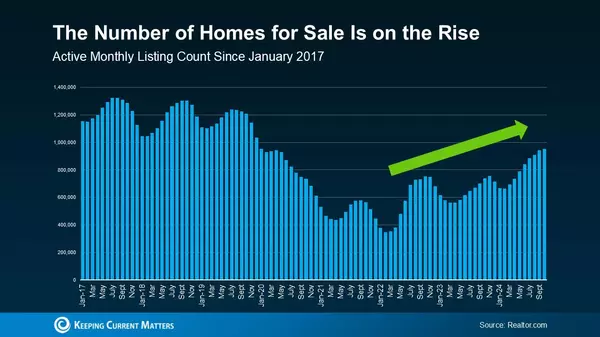

Every seller aims to sell their home quickly and at the best price, but an inflated asking price can undermine this goal. Here are four signs that your home may be priced too high: Few Showings or Offers: If your home isn’t attracting many buyers, it could be due to an unrealistic price. Potential buyers may bypass your home if they perceive it as overpriced compared to similar properties. Consistent Negative Feedback: If feedback from showings indicates your home is overpriced, it’s a strong signal that you may need to adjust your pricing strategy. Understanding how buyers perceive your home compared to others is critical. Your real estate agent can analyze this feedback and guide you in making necessary adjustments. As the National Association of Realtors (NAR) notes, agents often adjust initial price recommendations based on market conditions, property uniqueness, or other factors that impact value. Learn more from NAR. Extended Time on the Market: A home that lingers on the market without serious interest can become a red flag to buyers. They may assume there’s an issue with the property, even if the only problem is the price. With growing inventory, a listing that sits too long becomes stale, making it even more challenging to sell. Neighboring Homes Are Selling Faster: If homes similar to yours in the neighborhood are selling quickly while yours remains unsold, it could be a sign that your asking price is too high. This may be due to differences in upgrades, features, or simply an unrealistic price point. Bottom Line Pricing a home correctly is both an art and a science, requiring a deep understanding of the market and buyer behavior. If your home isn’t attracting the right interest, your real estate agent is your best resource to make the necessary adjustments. For further insights on determining the right asking price, refer to the National Association of Realtors.

Read More

Falling Mortgage Rates Are Bringing Buyers Back: Is It Time to Sell Your Home?

If you've been holding off on selling your home because of concerns about buyer interest, now might be the perfect time to reconsider. Recent shifts in the economic landscape have started to bring buyers back into the market, and falling mortgage rates are a key driver of this renewed activity. What’s Happening with Mortgage Rates? After months of high mortgage rates that kept many buyers on the sidelines, the tide is starting to turn. Due to various economic factors, mortgage rates are already beginning to drop. Just recently, the Federal Reserve cut the Federal Funds Rate for the first time since they started raising it in March 2022. While the Fed doesn’t directly control mortgage rates, this move sets the stage for rates to fall even further—especially with additional cuts expected into next year. Lower mortgage rates are already bringing more buyers back into the market. As Lisa Sturtevant, Chief Economist at Bright MLS, explains: “A drop in the cost of borrowing will help fuel more homebuyer demand . . . Falling rates will also bring more sellers into the market.” Buyer Activity Is on the Rise As mortgage rates decline, buyer activity tends to increase. The graph below illustrates this relationship, showing how a decrease in the average 30-year fixed mortgage rate (orange line) correlates with a rise in the Mortgage Bankers Association (MBA) Mortgage Application Index (blue line), which tracks the number of mortgage applications. This trend indicates that as rates fall, more potential buyers are re-engaging in the home-buying process. What Does This Mean for Home Sellers? According to the National Association of Realtors (NAR), home sales saw an uptick in July after four consecutive months of decline. This increase in buyer activity is promising news for homeowners considering selling. More buyers in the market can lead to increased competition, which often results in higher offers and shorter time on the market for your property. Edward Seiler, AVP of Housing Economics at the MBA, adds: “MBA is expecting that slower home-price appreciation, coupled with lower rates, will ease affordability constraints and lead to increased activity in the housing market.” This means the market is becoming more accessible to a broader range of buyers, potentially leading to even more interest in homes like yours. Read the latest insights from the National Association of Realtors Get Ready to Sell With more buyers entering the market, now is the ideal time to start preparing your home for sale. Increased buyer demand can work in your favor, leading to a quicker and more profitable sale. Bottom Line The recent decline in mortgage rates is already attracting more buyers, and experts expect this trend to continue. If you're considering selling, now is the time to connect with a local real estate agent who can help you capitalize on this increased demand. Contact me to get started.

Read More

Categories

Recent Posts