The Benefits of Using Your Equity for a Bigger Down Payment

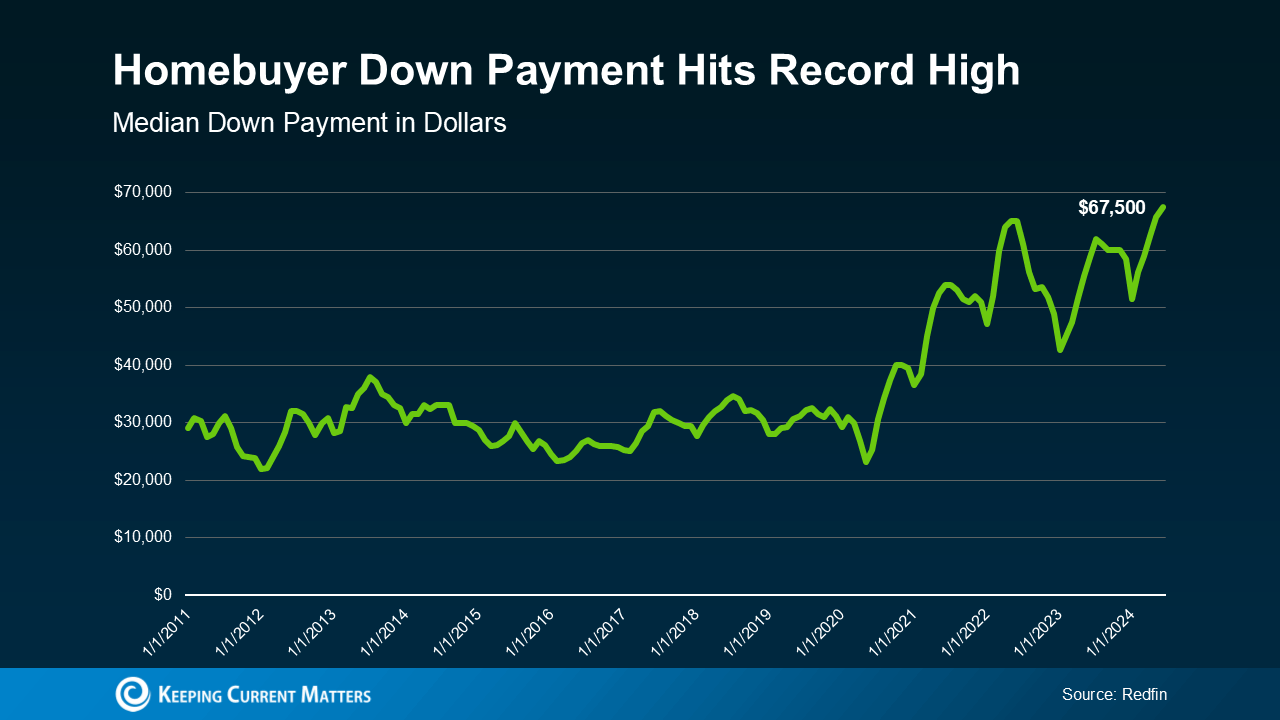

Did you know many homeowners can put more money down when buying their next home? That’s because they can leverage the equity they've built in their current property. As home equity has risen in recent years, so has the median down payment, which is now at an all-time high of $67,500—15% more than last year (see graph below).

This increase is largely due to rising home prices over the past five years, which have boosted equity for current homeowners. When you sell your house, you can apply that equity toward a larger down payment on your next home, which offers several advantages.

Why a Bigger Down Payment Matters

- You’ll Borrow Less: Using your equity for a larger down payment means you’ll borrow less and pay less in interest over the life of your loan.

- Lower Mortgage Rates: A bigger down payment signals financial stability to lenders, increasing your chances of securing a lower mortgage rate.

- Lower Monthly Payments: Borrowing less means your monthly mortgage payments will be lower, giving you more flexibility in your budget.

- Avoid Private Mortgage Insurance (PMI): By putting down 20% or more, you can skip the added cost of PMI, which saves you money every month.

Bottom Line

Homeowners are in a great position to use their equity to increase their down payment and unlock significant financial benefits. If you're thinking about selling your home and moving, contact a trusted real estate agent to explore how your equity can boost your buying power in today's market.

Categories

Recent Posts

GET MORE INFORMATION

REALTOR® | Lic# S.0184988