The Down Payment Assistance You Didn’t Know About

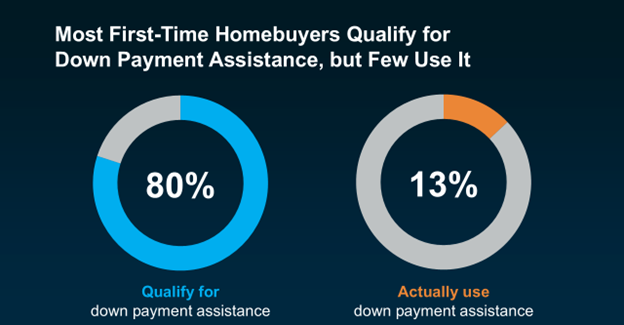

Did you know that nearly 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually take advantage of it? If you’re planning to buy a home, this is a gap you can’t afford to ignore.

Maximize Your Down Payment Options

First-time buyers can benefit from various resources, including loan options with as little as 3% down, or even 0% for qualified buyers like Veterans. Additionally, down payment assistance programs, such as grants, can help cover upfront costs. These resources not only boost your down payment but can also lower your monthly mortgage payments and potentially reduce fees like private mortgage insurance.

Don’t Be Deterred by Headlines

Recent news might suggest that down payments are on the rise. For example, Redfin reports that the typical down payment hit a record high of $67,500 in June. However, this increase reflects the choices of current homeowners who are leveraging their home equity to put down larger amounts, not a rise in down payment requirements. Larger down payments help lower monthly mortgage payments, which is crucial in today’s market.

Bottom Line

The best move you can make is to consult with a trusted lender. They can help you explore your options and access down payment assistance programs you might not even know exist. Working with a professional ensures you’re not leaving any money on the table and can help you get closer to your dream of homeownership.

Categories

Recent Posts

GET MORE INFORMATION

REALTOR® | Lic# S.0184988